Jeantet Tax Alert – Insurance and mutual health companies, march 2021

FRENCH CONTRIBUTIONS BASED ON PREMIUMS

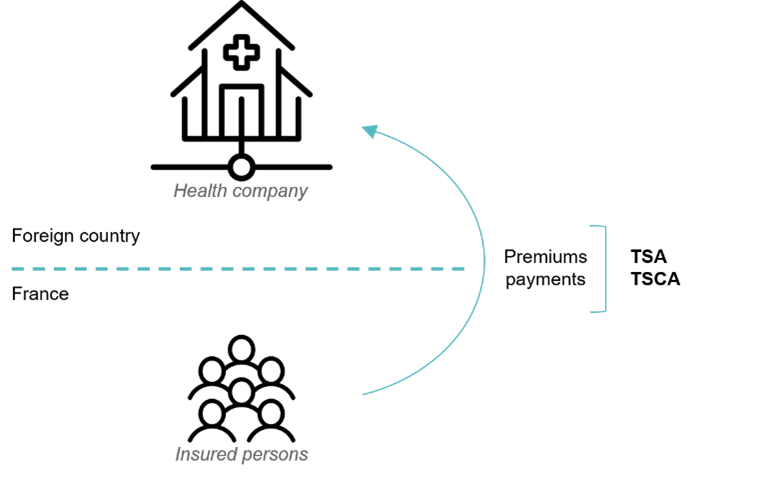

Foreign insurance and mutual health insurance companies (European or non-European) having insured individuals residing in France. If you have within your client individuals residing in France, you may have to respect some tax obligations, and particularly for social and tax matters. Such foreign companies are subject to 2 taxes in France: The taxe de solidarité additionnelle (i.e. « TSA ») and the taxe spéciale sur les conventions d’assurance (i.e. « TSCA »). In case of multiple guarantees, a very specific analysis must be done. – 20,27% of the premiums (persons affiliated to French social security scheme) or – 14% of the premiums (persons not affiliated to French social security scheme) Daily cash sickness benefits: – 14% of the premiums (either for persons affiliated or not to the French social security scheme) – 9% of the premiums (either for persons affiliated or not to the French social security scheme) paid by individuals residing in France. *Since 2019, a special 0,8% exceptional contribution is due for 2020. For TSA, companies must file a quarterly TSA social return CTP 135, 136 (URSSAF). For TSCA, companies must file a monthly n°2787 tax return (SIE des non-résidents). Depending on your situation, a tax representative appointment can be required by French social and tax authorities: Social and tax risks: Criminal risks: Tax fraud and criminal offense Activity risks: French regulatory authorities can act against foreign companies which are not complying with their French obligations. Possibility to obtain a dismissal of the penalties in case of self-regularization.

TSA

TSCA

Health insurance:

Non-health guarantees:

Legal Alert – Russian Counter-Measures

Recently the Russian competent authorities have adopted new counter measures. In particular, such measures concern trade regulation, conduct of business, as well as the activities of the Government Commission and others. To find out more, download the Newsletter or click here. For more information on sanctions and Russian counter measures, please refer to our previous “Legal Alerts“.

Desk Russia, Central Asia and Caucasus

Sanctions Against Russia. Recent Developments

On 23 February 2024 European Union and the United States introduced a new round of sanctions targeting Russia. The 13th package of European sanctions provides for new individual sanctions, sectoral sanctions, export restrictions. Additionally, EU added the United Kingdom to the list of partner countries for the iron and steel import restrictions. American sanctions include […]

Desk Russia, Central Asia and Caucasus

Newsflash – Corporate – Venture Capital – French government announcements to support Innovative Startup Companies (JEI)

For the occasion of the French Tech’s 10th anniversary, new measures stemming from the report of Parliament Member Paul Midy (for which Jeantet had been consulted) have been announced. These measures, which aim at supporting the French startup ecosystem, should be included in the next Finance Act for 2024. ► Doubling of companies eligible to […]

| CORPORATE – M&A – PRIVATE EQUITY

Russian Counter Measures. Recent Developments

On 23 August, the Russian Ministry of Finance partially lifted a ban for the payment of dividends to foreign shareholders in case such shareholders have invested in the Russian economy. On 8 August, the Russian President suspended certain provisions of double tax treaties. Suspended provisions include tax regime for dividends, real estate, business profit, etc […]

Desk Russia, Central Asia and Caucasus

Sanctions Against Russia. Recent Developments

On 23 June 2023, the EU introduced 11th package of sanctions. It primarily focuses on measures that would prevent circumvention of sanctions. It also includes new import and export restrictions and individual designations. Switzerland has joined European Union in sanctions targeting entities and individuals and may join other sanctions within the 11th package in August. […]

Desk Russia, Central Asia and Caucasus

Newsletter – Tax law

Read the Jeantet Newsletter dedicated to Tax Law, covering issues related to : Transactional taxation Group taxation International Taxation Taxation of LBO transactions Non-profit organizations For more information, please download the Newsletter.

Paris | TAX

Russian Counter Measures

On 25 April 2023 Russian President issued a decree establishing cases authorizing him to introduce the regime of external management of certain assets owned by foreign residents. Namely, under the decree, the President may establish the regime of external management, if Russia, or its entities and individuals become deprived or risk of being deprived of […]

Desk Russia, Central Asia and Caucasus

Russian counter measures and measures aimed at business support. Recent developments

Special regime for transactions involving securities On 3 March 2023 Russian President issued Decree No. 138 establishing additional measures involving securities. Namely, the new Decree establishes a specific procedure for transactions / operations involving: shares of Russian joint-stock companies, sovereign bonds, bonds of a Russian issuer, held in collective safe custody of a Russian depository, […]

Desk Russia, Central Asia and Caucasus

Sanctions against Russia. Recent developments (2 march 2023 update)

By the end of February, the EU, US and UK announced new rounds of sanctions, all of them including restrictions targeting prominent Russian financial institutions The EU package includes individual listings of Russian entities and individuals and additional exports restrictions. The US sanctions provide for sectoral sanctions targeting Russian mining and metals sector, as well […]

Desk Russia, Central Asia and Caucasus

Russian counter measures. Recent developments ( 12 january 2023 update)

Governmental Commission on Foreign Investments revised rules on the sale of assets and the payment of dividends On 30 December 2022, Russian Governmental Subcommission of the Commission of the Ministry of Finance on Foreign Investments (the – Commission) published revised rules and criteria for authorization of the sale of assets in Russian companies involving persons […]

Desk Russia, Central Asia and Caucasus

Sanctions against Russia. Recent Developments (21 December 2022 update)

This December, the EU introduced a series of restrictive measures targeting Russia. Council of the EU approved the ninth package of sanctions. Additionally, the European Commission proposed framework that would amend the Lisbon Treaty and harmonize criminalization of violation of sanctions at the level of the Union. Finally, the EU introduced a price cap for […]

Desk Russia, Central Asia and Caucasus

Russian counter measures. Recent developments (21 December 2022 update)

Russia has adopted a series of new measures. Namely, the President introduced new restrictions concerning certain transactions involving credit organizations and joint-stock companies that are not credit organizations. The Russian Central Bank issued decision expanding the scope of application of type C accounts. Moreover, the Ministry of Finance issued clarifications on the scope of transactions […]

Desk Russia, Central Asia and Caucasus